Great callout from David Shuttleworth of Anagram Ventures

https://www.linkedin.com/feed/update/urn:li:activity:7415084467536490496/

DIGITAL ASSETS EXPERTISE

Great callout from David Shuttleworth of Anagram Ventures

https://www.linkedin.com/feed/update/urn:li:activity:7415084467536490496/

Its incredibly rewarding to see the CFTC’s recent pilot program and allowance of the use of digital assets as collateral for CFTC-registered entities. Here is why it matters:

The CFTC’s recent launch of the Digital Asset Collateral Pilot Program is not merely as a regulatory “test,” but is the inevitable modernization of the global clearing ecosystem.

For a traditional financial services firm, the question is no longer “if” digital assets belong on the balance sheet, but “how” they can optimize capital and improve returns. Below is a strategic synthesis of CFTC Letters 25-39 through 25-41, rewritten through the lens of an implementation lead tasked with integrating digital assets into an FCM (Futures Commission Merchant) and clearinghouse framework.

The CFTC’s Global Markets Advisory Committee (GMAC) has cleared the path for a pilot program allowing the use of digital assets—specifically tokenized “traditional” assets (like T-Bills) and highly regulated stablecoins, plus some major non-stablecoin digital assets such as Bitcoin and Ethereum—as non-cash collateral.

For an FCM, this represents a shift from Static Collateral Management to Programmable Liquidity. Moving away from the friction of T+1 settlement and manual wire transfers toward a 24/7, real-time margin environment improves automation for counterparties and clearinghouses. Plus it allows for lower margin requirements, thereby improving ROI for traders and asset managers.

The focus must be on Risk, Reach, and Real-time.

For giants like Chicago Mercantile Exchange (CME) and Intercontinental Exchange (ICE), this pilot is an opportunity to redefine the “Gold Standard” of clearing.

Why should an Asset Manager or a Tier-1 Trading Firm care? The benefits are tangible and directly impact the bottom line:

The CFTC pilot is a signal that the “plumbing” of finance is being upgraded. For a traditional firm, adopting these capabilities isn’t just a compliance exercise—it’s a strategy to attract the next generation of institutional flow.

By leading on digital collateral, we aren’t just following a pilot; we are building the foundation for a more resilient, liquid, and efficient global market.

Stephen Leahy Digital Assets & Strategy Executive

I have stated previously that my favorite class at Babson was CSCA: Competitive Structure, Competitive Analysis. The late (great) professor Lawless challenged us to think big picture about the strategic and long term choices competitors make. To me strategic decision-making for companies is like the Beta part of public market investing….be correct with your allocation to sectors of the market, and the fundamental research “alpha” of small difference in marginal P&L of Coke vs Pepsi meant little.

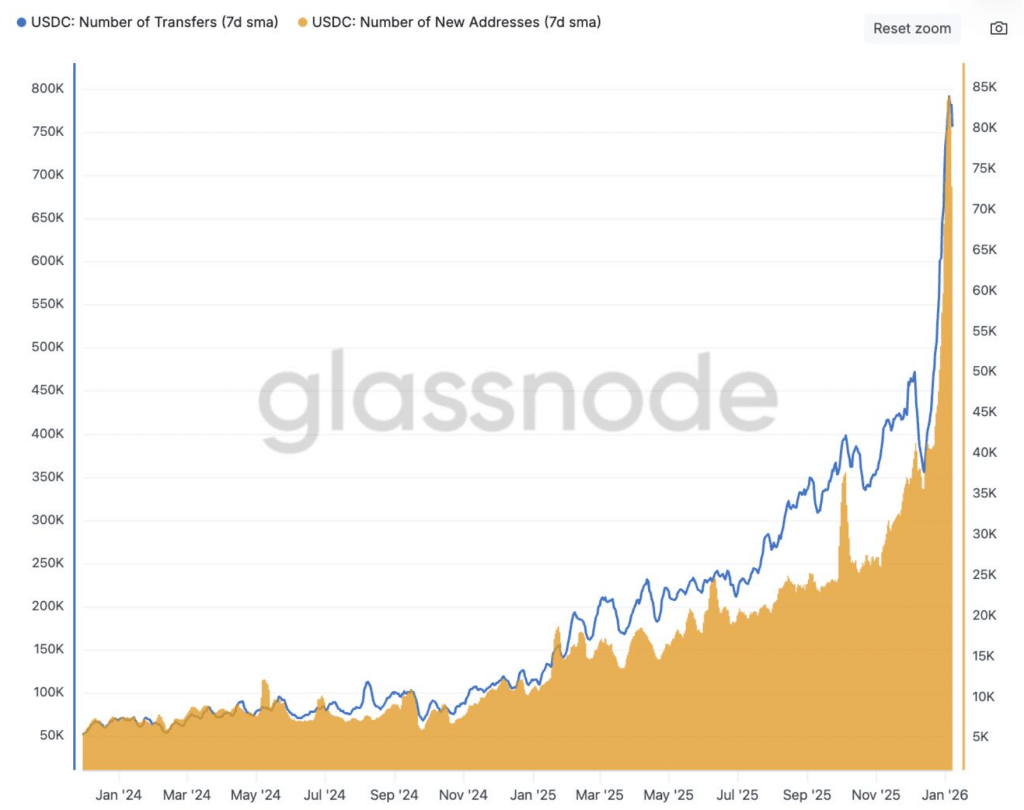

I was attracted to the industry of Staking after 3.5 years at Circle. I joined Circle in Jan 2021 as their first business development executive focused on the capital markets use cases of their stablecoin, USDC. I wanted to get closer to the actual functioning of blockchains as my time at Circle was coming to an end. As I did some research, the industry of staking was what caught my attention. While initially attracted to distributed ledgers and the idea of networks of servers being run by pseudonymous operators, I recognized that within financial services there would be need for the specialized services of staking the hundreds of billions dollars of proof-of-stake tokens held by institutional asset managers. And that is a large-scale opportunity.

I joined Kiln, a French company that was growing market share quickly in the staking services industry. An early entrant to staking, Kiln had a strong revenue base and the technical capabilities. They were consistently the best performing ETH staking service provider. And they had branched off and were very competitive in staking the other major PoS tokens. I joined as VP, Americas with a mandate to expand Kilns services in the US.

Providing staking services requires technical knowhow to run the machines (or vet and oversee the data center and hardware providers to do so), and blockchain engineers to build, run and update the specialized software that runs on the servers for each blockchain project. At this time there is no regulations or rules for compliance or reliability. So building a repuation of excellence is critically important; Kiln had that.

Companies offering staking services face a number of threats, which, combined, will cause the industry of staking services to be quickly absorbed by other service providers; the long-term outlook for independent staking service providers is poor.

While a unique set of services at this early time period in the use of PoS blockchains, Staking service providers have little moat and face even greater pricing pressure than other parts of the blockchain asset management value chain. Most blockchains are designed so as not to have staking penalties; why would they make it hard to maintain their network?!?! So low-cost operators are springing up quickly and offering 90% of the service and capabilities and reliability for half the price of the higher-reliability service providers.

The next strategic challenge the staking industry faces is from other service providers to asset management companies. If you are an existing custodian, who uses custody as a loss-leader, offering staking services is a riskless way to generate margin on thos same assets you are custodying. Staking is a 24/7/365 revenue generator with no market risk. That is more appealing to a custody CEO than adding a trading desk.

Finally, the Bitwise acquisition of Attestant in November 2024 will act as a blueprint for other asset managers. Bringing the staking services in-house adds a large margin to their businesses and does not require additional marketing spend. The Asset Managers are already competing in a very competitive field to land new AUM. When looking at some ETF revenue numbers, Bitwise charges 10bps on their Ethereum ETF; thats a tight margin. Knowing staking for ETF assets is would be approved in the US if Trump won the election, their purchase of Attestant is so smart. The staking services companies were pitching Bitwise with a service fee of 7-10 bps of the staking rewards. Lets do the math:

$1 million worth of ETH gets staked and returns the ETH average of 3% per annum. Thats $30,000 in staking rewards (assumes ETH price does not move). Paying 10bps service fee to an external staking service provider would cost BitWise $30 in costs and offset any additional revenues generated by the staking service.

So the staking industry is facing unbridled competition as every blockchain coder thinks to themselves, I run my own nodes, why don’t I just start offering that as a service. And the staking service providers are not as critical as some of the other asset servicing companies like professional asset manager and custodians (and prime brokers, lenders, etc).

Final thoughts: I can see the need for institutional holders of PoS assets needing the technical expertise of some blockchain coders in-house if they decide to execute their own staking services. But those firms already have a strong DevOps groups and teams, and its not like Fidelity or Blackrock are rushing to add the 43rd PoS blockchain that is going to launch this year. They are focused on ETH and Solana is making in-roads. No one at Blackrock is building on Berachain.

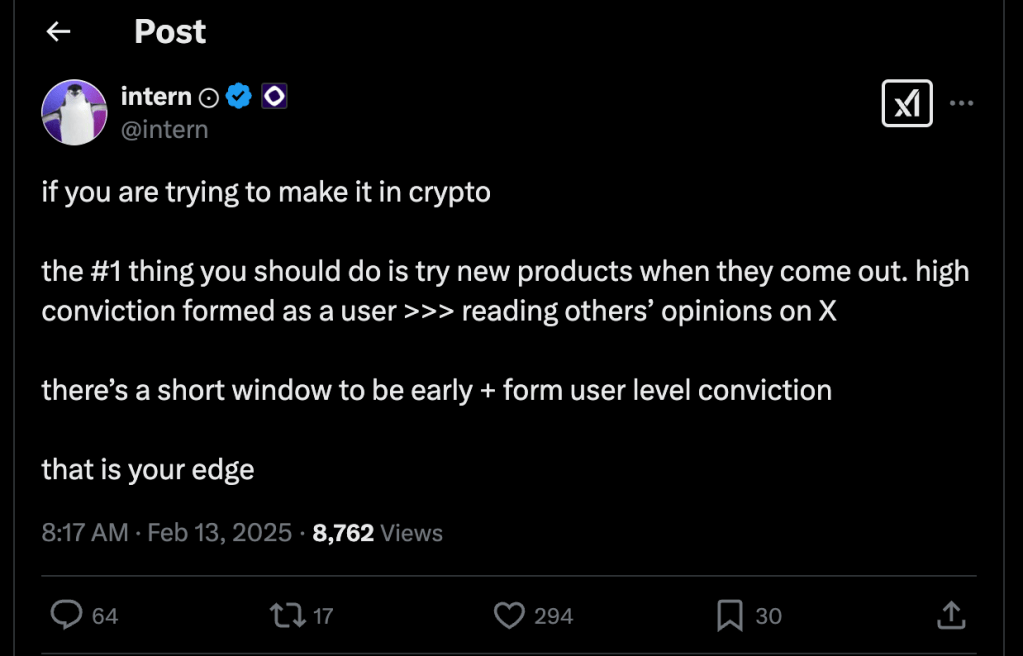

I saw a recent post by @intern on x.com

And I was reminded of a lesson learned while I worked at Circle.

After a restructuring of the Revenue Team, I had inherited a “sales team” that had been hired by two different managers. Some had been hired to sell Circle’s minting/redeeming API’s to corporates, some had been hired to sell Circle’s Yield product. I was given this team at the same time as I was put under a newly hired Vice President. So I had a new boss, and a new team.

To get things started we held a team meeting in NYC and as part of that we had a poker night. We used chips for the pot and at the end of the evening it was time to settle up so we netted some payments and determined who owed and who was getting paid.

I offered to pay my share in USDC and the three people I was to pay all stated they did not have a wallet on their phone. I then asked everyone (including my newly appointed boss) who had a USDC wallet on their phone. Only 2 of the 9 other attendees had an active USDC wallet. I was stunned and disappointed. And realized I had more work to do.

I instituted weekly “crypto” training and testing in addition to their responsibilities to sell and help with market validation projects we worked on; RWA & Margin Collateral. Within 3 months I had let go of 3 of the 8 on my team. The others stepped up and have all had great success inside or external to Circle.

The lesson reiterated to me, especially now in early 2025 when there are a flood of global bank VP’s looking to cash in on their connections to hedge funds and land high-paying roles with crypto projects…..to move this industry forward we need missionaries, not mercenaries. It becomes very clear when on a call with prospects, clients, partners, vendors…..there are those who deeply understand the use cases and ability of distributed ledgers to solve a challenge. And there are those who are filling a quota.

I previously wrote a personal blog at ARHAIK.com from 2013 – 2019. The blog was intended more for my own writing and thought-processes than for a public audience. I occaisionally post content from ARHAIK.com to Conmodum.co’s “Of Interest” section. The below is from February 2016:

The below are excerpts taken from the first chapter of an extensive article in the New York Times magazine. I have always been a student of capturing performance in organizations. Some of the information in this article (I have only yet gone through Chapter One) goes against traditionally-accepted norms for building and managing teams. My personal highlights are below. Italicized words are directly copied from the NYT Magazine Article.

I used to write regularly at ARHAIK.com (2013 – 2019) but no longer post there. I occasionally import a blog post from that site to Conmodum.co’s “Of Interest” page. The below is from Feb 20, 2017……

I expect I will write about this subject more often. I have spent a lot of time reading and thinking about it, and as Visual Trading continues to add momentum and employees I will use this place as a means to flesh out my thinking.

As leader of remote teams, I have recognized the importance of following up and repeating myself for expectations. Even small items like how to use a ticketing platform. One of the teams implemented a new platform, and with any new platform there is a learning curve. We tried a few features and functions (“F&F”), choosing to keep using a few and abandon some others. With this baseline usage, we decided to add other F&F’s. Like most new processes, we try things for a few weeks, share our thoughts, and determine whether to continue or abandon.

Though it was discussed on an informal call, some off the team members are not using the new F&F’s. I got frustrated once, but then realized that to fully implement usage, I am asking people to change their habits. So I need to help them understand how to change their habits. Merely demanding it is not enough.

How to help change habits? Today when the first few support tickets rolled in, I told the team not to load them into the ticketing platform. Once there were four tickets I grabbed the two team members who had not been using the new F&F’s and together we input the tickets using the new F&F’s. I helped them see what we are doing and why I think it will work. And I re-iterated their input on the F&F’s will be important when we review in a few weeks.

As I have monitored the ticketing platform today, I see the new F&F’s being used by all team members. With a truly remote team, the ability to cajole usage by sitting next to someone is not there. And “public” reminders via team chats are not great either. So topic-specific training from the top down is now a part of my processes when we want to implement a new process or procedure.

PS – When I went to search for an image to tie into this post, I typed in “remote training”, which Google auto-filled as “remote training collar” and populated the search with electric shock dog collars. I am not condoning the use of electric shock collars on team members (yet). 😉

In the next 5 years, distributed ledgers, or blockchains, will be widely adopted. This isn’t about “crypto” and its ups and downs; it’s about using secure, distributed ledgers to improve how we store and transfer value.

Here, I use “value” as a broad term. Some find value in sharing research among medical teams through zero-knowledge proofs, which validate outcomes without disclosing proprietary methods. Others find value in something called “Fartcoin.” Many popular use cases fall somewhere between these two extremes.

So what will have “value” now and in the future? For the next five years, it will be Data, the Networks that carry data, and the Power required to run the machines that handle and store the data.

Maybe the real Layer-Zero is the global power grid, and Power itself is the ultimate token.

Those I have worked with over the last few years know my obsession with using tokenized High Quality Tokenized Assets (HQLA) as margin collateral and a means of settling trades. Broadly defined, HQLA is cash held at banks, cash that has direct access to a Sovereign’s Repo Window, or short-term Sovereign debt like T-Bills.

🧠The opportunity to update current collateral processes is massive.There is approx $505 Billion in centralized clearinghouses as of Sept 30 2024. And ISDA’s December 31 2023 reporting of $1.4 Trillion collateral outstanding is mind-blowing. That’s approx $2 Trillion of cash and short term sovereign notes sitting in traditional vaults and moving on slow and costly rails. We can do better.

For financial institutions, asset managers, and corporates, tokenized collateral represents a bold step toward greater flexibility, cost savings, and efficiency. As the ecosystem matures, this could redefine how we view collateral management in both cleared and non-cleared markets.

The new US Administration’s recent Executive Order, Circle’s purchase of Hashnote & partnership with Digital Asset’s Canton Network, and conversations I have had with custodians and asset managers show me this massive market is finally attracting the attention it deserves. Some thoughts below:

🔗 Why This Matters:

1️⃣ Increased Efficiency: Tokenized assets allow for near-instant settlement and real-time tracking, addressing operational delays in traditional collateral management.

2️⃣ Improved Use of Capital: When collateral can move 24/7, in seconds, at almost zero cost, less collateral will be needed to support open positions thereby unlocking more capital to be put to use.

3️⃣ Transparency & Security: Built on blockchain, tokenized assets offer unparalleled transparency and reduce counterparty risks through immutable records. We still need to get the right mix of transparency and privacy so that firms do not have to disclose their positions, but that is an easy, though not simple, build.

📜 Recent Developments:

🔮 The big questions: Are we ready to fully embrace this paradigm shift? With clear regulatory frameworks and ongoing collaboration, tokenized assets could revolutionize the future of collateral.

Let’s discuss: How do you see tokenized assets impacting collateral frameworks? Are you exploring their potential? Drop your thoughts below! 👇

#Blockchain #TokenizedAssets #Collateral #ISDA #Clearinghouses #Innovation #Finance

I have used ARHAIK.com as a personal blog with the majority of writing taking place between 2016 and 2018. The below was posted March 14, 2016.

“You either tell the computers what to do, or the computers will tell you what to do.”

I first heard this line from Jesse Johnson, co-founder of oneZero Financial Systems, many years ago. I see it proven correct time and time again. It is why I allow my kids extra time on their tablets if they are on Code.org, or Tynker.com. I believed it when Jesse said it, and I see it everyday, you either tell the computers what to do, or the computers will tell you what to do. And I believe those who are succeeding now and will succeed in the future will be those who tell the computers what to do. That does not mean you have to be a coder (though it helps). It means you have to be able to understand how to make value out of the hardware and software and those people who can code.

Leaprate.com has an interview with the head of marketing for a brokerage firm that built their own sales/marketing/retention automation kit and now they are selling that to outside entities. In reading the interview I noted how many time she referred to the “humans” who are acting on triggers which come from the “platform” (read as software).

Another company in the Margin Trading Products (“MTP”) industry gained a lot of visibility and value with their ability to onboard and retain a massive amount of clients and assets with a very small sales and retention staff. Plus500 (LON: PLUS) was at one point worth more than $1 Billion GBP (approx $1.45 Billion USD). The company had fewer than 200 employees; I had been told by a reporter in Tel Aviv there were just 86 total employees at the company’s height.

The company has been through a lot of corporate drama since it’s highest valuation in May 2015. The UK’s FCA halted their client on-boarding due to KYC/AML issues but has now been re-instated. Corporate takeovers have been announced then abandoned. And C-suite turnover has been high in the last three months.

But the real story is Plus500’s quiet rise to prominence and the lessons other industry firms are working to learn and implement.

Plus500’s business model kept the company focused on a business paradigm that had been all but abandoned in the previous 7 years. Other brokerage firms had long ago given up the on proprietary trading platform and direct marketing as a business model. Most brokerage firms were offering and promoting a commonly-shared trading platform; MetaQuotes’ MetaTrader4. And brokerage firms focused on supporting independent Introducing Brokers (“IB’s”) as a primary means of sourcing clients. With a common trading platform there was little to prevent a client from switching from Brokerage Firm A to Brokerage Firm B. So the brokers were engaged in a market share war with the main differentiation being the price shown to clients, and any promotions given to land a client. The average cost to acquire a user went down significantly, the time and costs to educate a user on how to use the trading platform went down, but the lifespan of a client went down as well since there was an increasing amount of clients lured away by competitors.

But Plus500 went the old school route. They had a proprietary platform so that once clients learned to use the Plus500 platform, it would not be simple for clients to switch brokers as they would need to learn a new platform. Plus500 also went after new traders, rather than compete with other firms for existing traders. This is significant because it increased their costs per user acquisition, but it allowed Plus500 to target users who were not as price sensitive as existing clients. So while price spreads at most brokerage firms were getting squeezed, Plus500 enjoyed considerably larger gross margins than their competitors.

Plus500 also run their advertising campaigns almost completely outside the lines that the MTP’s traditional brokerage firms use. And I have not been able to determine where Plus500 advertises, nor what keywords they use. I read and search multiple MTP industry websites and keywords every day. Even using foreign VPN’s to access information on firms that do not cater to individuals who reside in the USA such as myself. But never has a Plus500 banner or search result showed up on my screens. And when I ask other industry executives these questions about Plus500, they seem to all have an “Ah-Hah!” moment. They, too, realize that Plus500 is successfully sourcing new clients from non-typical sources. The only information I have gained as to Plus500’s advertising is from the industry reporter who informed me Plus500’s advertising is wholly data-dependent, and targets the tangential prospects rather than the openly interested prospects.

Finally, Plus500 built and runs a sales / onboarding / retention automation system that blows competitors out of the water. Using a foreign VPN, I signed up for a demo account. I do not know if they built their CRM completely from scratch, or if they used an existing CRM platform as a basis. But the login they coded into their automation works! Demo accounts that have a few successful traded get an auto-generated e-mail congratulating them and placing a simple Call-To-Action (“CTA”) in front of the demo user to open a live account. The pattern of e-mails to my Inbox is not predictable (like most companies use).

The on-boarding process is what got Plus500 in trouble with the FCA. Simply put, Plus500 did not require full documented KYC/AML documentation prior to allowing clients to start trading. The requirement to complete all stages of KYC/AML paperwork was not needed until/unless a trader wanted to withdraw funds. It is important to note that this practice cost Plus500 half it’s market cap when the FCA halted client on-boarding in the Plus500 UK subsidiary (Cyprus-based operations continued as normal). Plus500 has since changed their on-boarding policies for UK clients and the company has regained much of it’s value. But by allowing clients to deposit and start trading quickly, and by making it more complex to withdraw funds, Plus500 has been able to generate more revenues from each trader. So while blatant disregard for KYC/AML rules is unacceptable, many companies are now working to make their on-boarding process as short and simple as can be allowed while maintaining the integrity of the process.

To bring this discussion back to my headline, Plus500 quickly built an extremely profitable MTP brokerage. And a significant aspect of that growth was because the founders understood the possibilities of successful automation. They told the computers what they wanted and allowed the computers to determine the most efficient processes, and the computers largely did the work. Less than 100 employees and a $1.45 Billion USD market cap in just 5 years is quite a feat.

So do not expect me to be creating and managing sales and retention teams of 100 people around the globe any time soon. You will find me sourcing coders and big-data specialists who can leverage the power of computing by telling the computer what to do.

I have used ARHAIK.com as a personal blog with the vast majority of writing taking place from 2016 – 2018. The below was from a post on April 7, 2016

The recent spate of state legislatures to enact, or attempt to enact discriminatory laws (North Carolina, Georgia, Mississippi) has me thinking about each of our differences and how it really effects others in your society. Mississippi voters want to be able to discriminate based on their perception of another person, but what if they are wrong? How do they know if someone is gay if that person does not specifically convey their sexual orientation?

Each of us has differences, and what can make those differences important is if the difference is visible or not, how deeply the difference effects you, and how deeply it can effects others (if visible or known). I have come to think of it as a simple (but important), three axis chart.

X-Axis: Is your difference visible to others? One of my ears is shaped slightly different than my other. This is a minor difference that has been noticed by a minuscule fraction of a percent of people I have interacted with. In fact it has never been mentioned to me, but I can see it in the mirror. But some people’s differences are massively noticeable; an amputee, someone with facial burns, someone who chooses to dress outlandishly (or conservatively), or a gay couple who choose to show their love with public displays of affection. This matters to the individual as it effects how others in society view each of us. And that, in turn, has an effect on how we view ourselves.

Y-Axis: How a difference effects ourself. My slightly and almost imperceptible difference in ear size effects me exactly zero. I can not think of any event in my life that has been effected by the fact that my ears do not perfectly match. But for someone who is gay, or of a certain religious belief, or someone who believes aliens reside on Earth…..their daily actions are effected by their difference. The gay couple may choose not to go to a certain restaurant (or straight people may choose not to go to a certain part of town), the Buddhist may need to take time during the day to pray, and the people who believe aliens walk among us, well, not sure how they are effected but that must effect your day-to-day decision making.

Z-Axis: How other treat you due to any visible difference. Maybe the alien-believer lives in a community in Northern Arizona where everybody believes aliens inhabit Earth. That makes life a lot easier for the believers. But what if the gay couple live in a small beach community in a state that just passed a pro-discrimination law? Do they now avoid certain stores? Will other citizens treat the gay couple differently now? Do they need to uproot their lives and family and move to a different state?

But this raises two important questions….1) How do we know what any person’s difference(s) are unless they purposefully tell others? If I showed you a picture of a conference I attended and stated that two people are gay and one transgender, I bet you could not pick those three out of the 28 people in the picture. So for those who support the pro-discrimination laws, how do you who to discriminate against? And what if you are wrong, are you opening yourself up to civil or legal complaints?

2) Why care what others’ differences are if you can not see them and they do not effect you? You probably do not see the differences in my ears, and even if you looked real close, would that difference effect how you view and treat me? What if I was a Buddhist? What if I had a massive scar on my back (that you can not see unless we are at the beach) because I donated a kidney? And for my fellow conference attendees who are either gay or transgender, if you can not see they are different than you, you could not purposefully discriminate against them, correct?

So what does it matter what one’s differences are so long as the person is not causing harm to you and your society? The pro-discrimination crowd will tell you it is about religious liberty. That their belief of something is so strong, that they can not accept it even in others. That it is not good enough to live by one’s own creed and beliefs, but that one has the right to force one’s own belief on others.

But can that be the case? Is that a valid way to view society? Or do they believe in that only when they are in the majority? Because those who are pro-discrimination and back laws to allow them to discriminate based on their beliefs are likely to change their tune if those they discriminate against were to gain the majority.